I've stated this several times before, but I'll state it again for the record: You'd have to be pretty damn naive to believe the stated intention of any government. It is always a good idea to try to read between the lines and establish what you think the hidden agenda is. Unquestioning acceptance of the government line on any issue is pretty naive, but in the case of "Bedroom Tax" it shows a remarkable willingness to ignore the wealth of evidence that the "freeing up larger properties" narrative has more holes in it than a colander.

The first, and probably the most obvious indicator that the real intention has little or nothing to do with "freeing up larger properties" is that pensioners are exempt. Pensioners are by far the most common under-occupiers of larger social housing properties, yet the Tories decided to let them keep their "oversized" houses. The motivation for exempting single pensioners or couples that may be occupying 3, 4 or even 5 bedroom social properties is obvious. Pensioners are the single biggest Tory demographic. The Tories know that the majority of social housing tenants don't vote Tory, but they are petrified of a wider pensioner backlash if they are seen to be forcing pensioners out of their homes. Hence, the single biggest supply of under-occupied social housing will not be reallocated through collective financial punishment, for party political reasons.

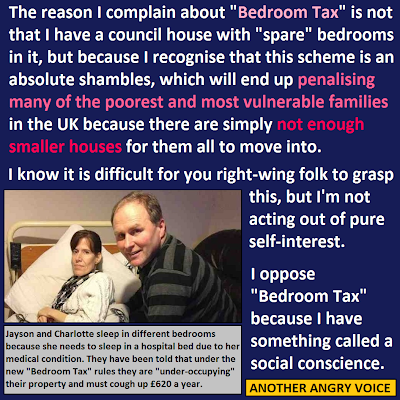

The next problem is the abject lack of smaller accommodation. Even if people wanted to "downsize" their property, there simply isn't enough smaller accommodation available for everyone to do it. To put the scale of this shortage into perspective, the figures from Hull show that 4,700 families are due to be hit by "Bedroom Tax" yet there are only 73 smaller properties available, meaning that even if every smaller property is allocated to "Bedroom tax" refugees, that will only be enough for 1.56% of them, the other 98.4% will have to pay the charge, or seek private sector accommodation.

What makes the lack of smaller social housing even more of a problem is the few properties that are available won't generally go to relocating tenants from larger properties because high priority cases (such as the homeless and families living in temporary accommodation) always get priority access and there are vast waiting lists for social property in nearly every area.

The next clear demonstration that the policy has very little to do with the stated objective of "freeing up larger properties" is that the government repeatedly claim that "Bedroom tax" will save £480 million a year. It turns out that in order to calculate this guesstimated figure they have assumed that 85% of people will not be forced out of their homes by the "Bedroom Tax" charges. Slamming 17 low income families with additional housing costs in order to incentivise just 3 families to relocate is basically a form of collective punishment. The Tories know that most people will be either unwilling, or more commonly unable, to move out of their family home and they've worked that failure of their repeatedly stated justification into their financial projections.

Sticking with the endlessly repeated claims that "Bedroom Tax" will save £480 million a year, this flatly contradicts their "freeing up larger properties" narrative. Either the "Bedroom Tax" is about reallocation of property, or it is about saving £480 million at the expense of some of the poorest and most vulnerable families in the UK. It can't be both.

Another problem with the narrative that "Bedroom Tax" is all about "freeing up larger properties", is due to the chronic shortage of smaller social housing properties, large numbers of families that are financially penalised out of their homes would end up moving into the private rental sector, where rents are vastly more expensive, with higher rates of Housing Benefit. The fact is that people fleeing "Bedroom Tax" would actually be entitled to significantly higher Housing Benefit payments for their their smaller private sector properties, than they were initially receiving for their larger social housing properties. The remarkable thing about this is, that the more successful this policy is in meeting the stated objective of "freeing up larger social properties", the more it is going to cost the taxpayer in increased Housing Benefits payments. Once again, this is evidence that if the stated "freeing up properties" justification is realistic, then the £480 million projection is false, and if the £480 million projection is accurate then the "freeing up larger properties" narrative is a load of rubbish.

Given their undying devotion to the pumping public funds into the private sector and assurances from the likes of Welfare Reform Minister David Anthony "Lord" Freud that he is not expecting private sector landlords "to suffer a large loss of income" due to Tory welfare reform policies, it is not difficult to imagine that the "Bedroom tax" is actually a scheme designed to siphon more taxpayers' cash (via private sector Housing Benefit subsidies) into the bank accounts of private landlords.

Scratch beneath the Tory propaganda and it becomes pretty obvious that "Bedroom Tax" has nothing to do with "encouraging" families to move into more appropriate accommodation and everything to do with financially penalising hundreds of thousands of the poorest and most vulnerable people in society, with the "added bonus" (from a tory perspective) of shifting even more public cash into the private sector. It is not, as the reactionary Tory apologist likes to claim it is a policy aimed at "freeing up larger properties", it is, in fact, a vindictive scheme to collectively punish the poor and further enrich the wealthy.

"Bedroom tax" is Tory malice dressed up as social engineering.

Another Angry Voice is a not-for-profit page which generates absolutely no revenue from advertising and accepts no money from corporate or political interests. The only source of revenue for Another Angry Voice is the PayPal donations box (which can be found in the right hand column, fairly near the top of the page). If you could afford to make a donation to help keep this site going, it would be massively appreciated.

More articles from

ANOTHER ANGRY VOICE

"Bedroom Tax" and Tory hypocrisy

Why I oppose "Bedroom Tax"

What is ... a justification narrative?

Lord Freud: Risks, corpses and slums

The Back to Work Jobs Guarantee

A letter to fans of Workfare

A coalition of LTBs

The Atos "disability denial factory"

Gaming the Work Programme

The Workfare ship is sinking

ANOTHER ANGRY VOICE

"Bedroom Tax" and Tory hypocrisy

Why I oppose "Bedroom Tax"

What is ... a justification narrative?

Lord Freud: Risks, corpses and slums

The Back to Work Jobs Guarantee

A letter to fans of Workfare

A coalition of LTBs

The Atos "disability denial factory"

Gaming the Work Programme

The Workfare ship is sinking

1 comment:

Hi Thomas,

Great article! I was just wondering if you have a source for the 85% stat as I would love to look into this further.

Best wishes

Post a Comment