One of the things that really annoys me is hearing Coalition ministers bragging on about how successful they have been in "keeping inflation low". One particularly egregious example came from the Tory party Minister for Police and Criminal Justice, Damian Green. He cited "keeping inflation low" as one of the "key successes" of the Coalition government during an excruciating performance on Question Time, in which he didn't just limit himself to misleading claims about inflation, he also used plenty of fallacious justification narratives and put in a rapid fire bout of outright lying for good measure.

Damian Green's claims about "keeping inflation low" contradict the everyday experience of millions of people who have experienced huge above inflation rises in almost every area of spending, including: petrol prices, public transport fares, supermarket shopping, electricity and gas, water rates, private rented accommodation and child care. The average person has witnessed above inflation rises in almost every aspect of their lives.

Pretty much everyone that has had to live on a tight budget for the last three years is well aware that prices have been soaring and that it is ever more difficult to make ends meet. The contrast between people's very real experiences of rising prices and the official inflation measures which consistently tell us that inflation is actually very low leave us with several questions:

If the cost of almost everything is rising above the official rate of inflation, how can the official rate of inflation be accurate? And if it isn't measuring everyday spending, then what is it measuring?

I believe that the official inflation statistics are both inaccurate and presented to the public in a desperately misleading way. Here are just a few examples of how the real scale of inflation is been hidden via "innovative" industry practices and through the misleading way that inflation is actually measured and reported.

Product debasement

The use of Romanian horse meat in various supposedly beef based processed foods during the 2013 horse meat contamination scandal is not the only example of food manufacturers using cheaper alternative ingredients. Another particularly disgusting ingredient found in processed food is mechanically recovered meat. It is an obvious consequence that at a time of falling consumer spending (caused by Osborne's ideological austerity experiment) the easiest way to keep profit margins high is to debase the standard of the product rather than to try to charge the cash strapped consumer more money that they simply cannot afford.

Size reduction

Some supermarkets have taken to the con-trick of reducing the net weight of products such as tinned fish, shampoo and toothpaste without reducing the sale price. Many customers would fail to notice that the product they usually buy has been reduced from 568ml to 500ml, hence the increased cost of the product is hidden from customer perception. What makes it even worse is that the price of the product is invariably raised later on in the year too.

RPI and CPI

There are two key measures of inflation in the UK: The Retail Price Index (RPI) and the Consumer Price Index (CPI). CPI is almost always lower than RPI, this leads to the situation that the government tend to take money from us based on the higher RPI measure (student loans), but when it is distributing money, (pensions and other benefits) it often uses the lower CPI instead.

Excluding housing costs from calculations

The reason that CPI is almost invariably lower than RPI is that the CPI calculations exclude things like housing costs. A 2012 Home Let Index showed that rents have risen an average of 6% across London in the last year, 16% in the last two and 32% since 2009. If these inflationary factors are excluded from the calculations, then it is totally obvious that the official inflation stats will be distorted downwards and fail to reflect the actual significantly higher rises in the cost of living experienced by millions of people.

Duking the stats

The US based website Shadowstats claims that changes to the way inflation indices are calculated have massively depressed the numbers. According to them; if CPI was calculated the way it was in 1990 inflation would currently be almost 6%, while the 1980 method would shown CPI at almost 10%. It would be naive to assume that similar techniques have not been used to depress the official inflation rate in the UK too.

There was a lot of pre-election rhetoric about resolving this large disparity between the two inflation indices. The 2010 Coalition agreement stated that "We will work with the Bank of England to investigate how the process of including housing costs in the CPI measure of inflation can be accelerated".

Well instead of doing that, they've changed track completely (yet another Tory U-turn!) and they are now determined to manipulate the RPI measure downwards instead by replacing it with a new lower measure called RPIJ, which, according to the BBC website will "be promoted each month, with the old RPI measure being given much less publicity."

Inclusion of high-tech items in calculations

In 2011 the president of the New York Federal Reserve, William Dudley stated that while food and energy prices had indeed gone up, other prices had fallen. He cited this now infamous example "Today you can buy an iPad 2 that costs the same as an iPad 1 that is twice as powerful". His justification for the production of misleading inflation statistics was not well received. Some jokers echoed Marie Antoinette by referring to his statement as the "Let them eat iPads" speech.

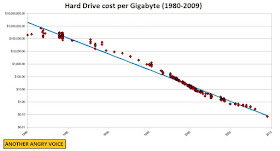

The graph on the right demonstrating the exponential decline in memory storage costs gives an indication of why the inclusion of high tech equipment in the "basket of products" used to calculate inflation tends to distort the figures downwards.

If we consider the fact that the majority of poor households spend little or nothing on high tech equipment, in light of this high tech effect, it becomes obvious that poorer households must be experiencing higher levels of inflation than wealthier ones. Once again the poorest and most vulnerable people are hit the hardest, whilst the official government stats create a rosy picture of relatively low inflation.

Misuse of crude statistics

Probably the single most important issue to consider is the way that inflation is actually described. Whenever we hear the inflation rate in crude terms it is very easy indeed to fall into the trap of judging the percentage number in isolation. It is absolutely impossible for anyone that lived during the Thatcher government to forget the absurd inflationary spikes in the early 1980s and again towards the end of her regime in 1990.

When we hear the media report that the CPI rate of inflation is 3.1% it is easy to imagine that this is low, when we compare it in a crude manner with the 21.9% rate of CPI inflation in May 1980.

The problem is that considering these numbers in isolation, without reference to the underlying market conditions creates the misleading impression that inflation in 1980 was many times worse than it is now.

In order to demonstrate how crude comparisons like this can create hugely distorted perceptions, lets consider the UK national debt in crude terms (in £billions rather than as a percentage of GDP). In 1947 the UK national debt stood at £25.63 billion but by 1979 it had risen to £86.88 billion. Judging from these figures alone, the financially naive individual could hardly be blamed for thinking that the UK debt had spiraled out of control during the mixed economy era.

If these figures are adjusted to take into account the actual size of the economy at the time, a remarkably different, and much more accurate meaning can be gleaned from the comparison. Back in 1947 the £25.63 billion figure was equivalent to 237% of the entire economic output of the UK (GDP) and the £86.88 billion figure from 1979 represented just 43.6% of GDP. The reality was that between 1947 and 1979 the UK managed an unprecedented reduction in the size of the public debt.

Inflation to interest ratio

I believe that the previous example clearly demonstrates the absurdly counter-factual conclusions that can be drawn from considering crude economic statistics in isolation. I believe that the best way to put inflation statistics into real context is by considering their relationship to the central bank interest rate (the Inflation to Interest ratio). I believe this is a good measure because it highlights the relationship between rises in the cost of living with rises in the value of assets such as savings, pensions and wages, which are heavily influence by the underlying interest rate.

Let's return to the huge 21.9% inflation spike of May 1980 when Geoffrey Howe was the Chancellor. If we compare this enormous figure with the Bank of England interest rate, which was 17.0% at the time, we get an inflation to interest ratio of 128%, meaning that prices were rising 28% faster than the central bank lending rate. If we look at the next spike that occurred in September 1990 when John Major was chancellor, the inflation rate was 10.9% but the BoE interest rate was actually higher at 14.875% providing an inflation to interest ratio of just 73.3% meaning that prices were actually falling in comparison to the central bank interest rate.

Now lets move into the present era of Osborne's ideological austerity experiment, quantitative easing and the zero lower bound. Pretty much anyone that doesn't blank out the economics news entirely from their worldview must be aware that the Bank of England interest rate has been held at an all time historic low of just 0.5% for almost five years since March 2009.

Damian Green's claims about "keeping inflation low" contradict the everyday experience of millions of people who have experienced huge above inflation rises in almost every area of spending, including: petrol prices, public transport fares, supermarket shopping, electricity and gas, water rates, private rented accommodation and child care. The average person has witnessed above inflation rises in almost every aspect of their lives.

Pretty much everyone that has had to live on a tight budget for the last three years is well aware that prices have been soaring and that it is ever more difficult to make ends meet. The contrast between people's very real experiences of rising prices and the official inflation measures which consistently tell us that inflation is actually very low leave us with several questions:

If the cost of almost everything is rising above the official rate of inflation, how can the official rate of inflation be accurate? And if it isn't measuring everyday spending, then what is it measuring?

I believe that the official inflation statistics are both inaccurate and presented to the public in a desperately misleading way. Here are just a few examples of how the real scale of inflation is been hidden via "innovative" industry practices and through the misleading way that inflation is actually measured and reported.

Product debasement

The use of Romanian horse meat in various supposedly beef based processed foods during the 2013 horse meat contamination scandal is not the only example of food manufacturers using cheaper alternative ingredients. Another particularly disgusting ingredient found in processed food is mechanically recovered meat. It is an obvious consequence that at a time of falling consumer spending (caused by Osborne's ideological austerity experiment) the easiest way to keep profit margins high is to debase the standard of the product rather than to try to charge the cash strapped consumer more money that they simply cannot afford.

Size reduction

Some supermarkets have taken to the con-trick of reducing the net weight of products such as tinned fish, shampoo and toothpaste without reducing the sale price. Many customers would fail to notice that the product they usually buy has been reduced from 568ml to 500ml, hence the increased cost of the product is hidden from customer perception. What makes it even worse is that the price of the product is invariably raised later on in the year too.

RPI and CPI

There are two key measures of inflation in the UK: The Retail Price Index (RPI) and the Consumer Price Index (CPI). CPI is almost always lower than RPI, this leads to the situation that the government tend to take money from us based on the higher RPI measure (student loans), but when it is distributing money, (pensions and other benefits) it often uses the lower CPI instead.

Excluding housing costs from calculations

The reason that CPI is almost invariably lower than RPI is that the CPI calculations exclude things like housing costs. A 2012 Home Let Index showed that rents have risen an average of 6% across London in the last year, 16% in the last two and 32% since 2009. If these inflationary factors are excluded from the calculations, then it is totally obvious that the official inflation stats will be distorted downwards and fail to reflect the actual significantly higher rises in the cost of living experienced by millions of people.

Duking the stats

The US based website Shadowstats claims that changes to the way inflation indices are calculated have massively depressed the numbers. According to them; if CPI was calculated the way it was in 1990 inflation would currently be almost 6%, while the 1980 method would shown CPI at almost 10%. It would be naive to assume that similar techniques have not been used to depress the official inflation rate in the UK too.

There was a lot of pre-election rhetoric about resolving this large disparity between the two inflation indices. The 2010 Coalition agreement stated that "We will work with the Bank of England to investigate how the process of including housing costs in the CPI measure of inflation can be accelerated".

Well instead of doing that, they've changed track completely (yet another Tory U-turn!) and they are now determined to manipulate the RPI measure downwards instead by replacing it with a new lower measure called RPIJ, which, according to the BBC website will "be promoted each month, with the old RPI measure being given much less publicity."

Inclusion of high-tech items in calculations

In 2011 the president of the New York Federal Reserve, William Dudley stated that while food and energy prices had indeed gone up, other prices had fallen. He cited this now infamous example "Today you can buy an iPad 2 that costs the same as an iPad 1 that is twice as powerful". His justification for the production of misleading inflation statistics was not well received. Some jokers echoed Marie Antoinette by referring to his statement as the "Let them eat iPads" speech.

The graph on the right demonstrating the exponential decline in memory storage costs gives an indication of why the inclusion of high tech equipment in the "basket of products" used to calculate inflation tends to distort the figures downwards.

If we consider the fact that the majority of poor households spend little or nothing on high tech equipment, in light of this high tech effect, it becomes obvious that poorer households must be experiencing higher levels of inflation than wealthier ones. Once again the poorest and most vulnerable people are hit the hardest, whilst the official government stats create a rosy picture of relatively low inflation.

Misuse of crude statistics

Probably the single most important issue to consider is the way that inflation is actually described. Whenever we hear the inflation rate in crude terms it is very easy indeed to fall into the trap of judging the percentage number in isolation. It is absolutely impossible for anyone that lived during the Thatcher government to forget the absurd inflationary spikes in the early 1980s and again towards the end of her regime in 1990.

When we hear the media report that the CPI rate of inflation is 3.1% it is easy to imagine that this is low, when we compare it in a crude manner with the 21.9% rate of CPI inflation in May 1980.

The problem is that considering these numbers in isolation, without reference to the underlying market conditions creates the misleading impression that inflation in 1980 was many times worse than it is now.

In order to demonstrate how crude comparisons like this can create hugely distorted perceptions, lets consider the UK national debt in crude terms (in £billions rather than as a percentage of GDP). In 1947 the UK national debt stood at £25.63 billion but by 1979 it had risen to £86.88 billion. Judging from these figures alone, the financially naive individual could hardly be blamed for thinking that the UK debt had spiraled out of control during the mixed economy era.

If these figures are adjusted to take into account the actual size of the economy at the time, a remarkably different, and much more accurate meaning can be gleaned from the comparison. Back in 1947 the £25.63 billion figure was equivalent to 237% of the entire economic output of the UK (GDP) and the £86.88 billion figure from 1979 represented just 43.6% of GDP. The reality was that between 1947 and 1979 the UK managed an unprecedented reduction in the size of the public debt.

Inflation to interest ratio

I believe that the previous example clearly demonstrates the absurdly counter-factual conclusions that can be drawn from considering crude economic statistics in isolation. I believe that the best way to put inflation statistics into real context is by considering their relationship to the central bank interest rate (the Inflation to Interest ratio). I believe this is a good measure because it highlights the relationship between rises in the cost of living with rises in the value of assets such as savings, pensions and wages, which are heavily influence by the underlying interest rate.

Let's return to the huge 21.9% inflation spike of May 1980 when Geoffrey Howe was the Chancellor. If we compare this enormous figure with the Bank of England interest rate, which was 17.0% at the time, we get an inflation to interest ratio of 128%, meaning that prices were rising 28% faster than the central bank lending rate. If we look at the next spike that occurred in September 1990 when John Major was chancellor, the inflation rate was 10.9% but the BoE interest rate was actually higher at 14.875% providing an inflation to interest ratio of just 73.3% meaning that prices were actually falling in comparison to the central bank interest rate.

Now lets move into the present era of Osborne's ideological austerity experiment, quantitative easing and the zero lower bound. Pretty much anyone that doesn't blank out the economics news entirely from their worldview must be aware that the Bank of England interest rate has been held at an all time historic low of just 0.5% for almost five years since March 2009.

The latest official inflation date from December 2012 puts CPI inflation at a seemingly low 3.1%, however, the super-low BoE interest rate of 0.5% leaves us with a Inflation to Interest ratio of 620%. This shows us that in real terms a 3.1% rate of inflation in the current low-interest economic climate is actually significantly worse than Geoffrey Howe's 21.9% inflation spike in 1980, which was mitigated by the high interest rates.

The latest official inflation date from December 2012 puts CPI inflation at a seemingly low 3.1%, however, the super-low BoE interest rate of 0.5% leaves us with a Inflation to Interest ratio of 620%. This shows us that in real terms a 3.1% rate of inflation in the current low-interest economic climate is actually significantly worse than Geoffrey Howe's 21.9% inflation spike in 1980, which was mitigated by the high interest rates.If we look back to October 2011 the Inflation to Interest ratio was even worse, the rate of CPI inflation was 5.1%, creating an I-I ratio of an astonishing 1020%, meaning prices were rising 920% faster than the central bank interest rate, a figure that absolutely dwarfs Geoffrey Howe's 28%.

Wage to inflation ratio

Another useful comparison can be made between inflation and the average wage rise. This gives us important information about how price increases relate to increases in wages. If we look at the graph to the right we can see that before the economic crisis the monthly wage rise in October of each year generally remained slightly higher than the rate of inflation. The trend was reversed after the global financial sector meltdown of 2007-08 and since George Osborne took over at 11 Downing Street the deficit between wage rises and inflation has soared. In October 2011 when CPI inflation peaked at 5.1%, wages rises lagged far behind at just 2.1% meaning that the average wage rise was just 41.2% of the average rise in prices. For every extra £1.00 in wages above the previous year, prices had gone up by £2.43.

Another useful comparison can be made between inflation and the average wage rise. This gives us important information about how price increases relate to increases in wages. If we look at the graph to the right we can see that before the economic crisis the monthly wage rise in October of each year generally remained slightly higher than the rate of inflation. The trend was reversed after the global financial sector meltdown of 2007-08 and since George Osborne took over at 11 Downing Street the deficit between wage rises and inflation has soared. In October 2011 when CPI inflation peaked at 5.1%, wages rises lagged far behind at just 2.1% meaning that the average wage rise was just 41.2% of the average rise in prices. For every extra £1.00 in wages above the previous year, prices had gone up by £2.43.Analysis of the monthly Wage to Inflation ratio shows us that monthly wage rises have not surpassed the rate of inflation since the last months of the Labour administration, the very last month of a positive ratio was March 2010 when wages rose 4.9% on the previous year, whilst inflation had risen 4.4%, meaning that for every extra £1.00 in income prices had risen by just 90p.

Ever since the Tories got into power in May 2010 inflation has massively outstripped average monthly wage rises every single month. The very best month they managed was August 2012 (just after the Olympics) when the average wage rose by 2.3% and inflation rose 2.9%, meaning that for every extra £1.00 in earnings, prices rose by £1.26.

The normal range under this government has been monthly price increases of between £1.50 - £2.50 for every extra £1.00 in wages, however the worst month so far under Tory rule was March 2012 when prices rose a mind-boggling £36.00 on the previous year for every extra £1.00 in wages!

Conclusion

Hopefully this article has inspired you to think a little more about the prices we pay for things and the way that crude inflation statistics are misused by politicians and the press to create a ridiculously over-positive interpretation of the economic climate.

Perhaps you'll notice next time your usual brand of tinned sweetcorn or toothpaste suddenly shrinks a bit without the price falling accordingly, and perhaps next time you hear someone talking about inflation rates in crude, non-comparative terms, you'll have a little think about how an apparently low number like 2%, is actually a very high number if interest rates are at 0.5% or the monthly increase in earnings over the previous year is just 0.1% or perhaps even in negative territory.

Please feel free to leave me a message in the comments section below and let me know if you think there are any other aspects of "hidden inflation" that are worth a mention.

Another Angry Voice

is a not-for-profit page which generates absolutely no revenue from

advertising and accepts no money from corporate or political interests.

The only source of revenue for Another Angry Voice

is the PayPal donations box (which can be found in the right hand

column, fairly near the top of the page). If you could afford to make a donation to help keep this site going, it would be massively appreciated.

ReplyDeleteThe Loan Fund that Mr Benjamin offered me enabled me to take advantage of an incredible opportunity to relocate and expand my business, at a pivotal time. The support I received from The staff was priceless at the rate of 2% in return.

You can contact them for a loan request on 247officedept@gmail.com And WhatsApp -+1-989-394-3740

Hidden Inflation Explained is a blog post that gave such insights on something we often do not talk about. It is educative to know the mechanics of hidden inflation and how it affects our daily lives. As I was reading, I thought of how at times, unforeseen expenses appear as hidden inflation with regard to car matters especially. In huge cities like New York City where parking issues are common place, there is need for reliable and effective services such as towing in new york city. Paying immediate attention to towing challenges is not just for being convenient but also about avoiding costs whose source we could not anticipate.

ReplyDelete