The show, which featured five orthodox neoliberal guests (two members of the neoliberal coalition government, a member of the neoliberal opposition party, a neoliberal banker-economist and a Murdoch cipher from the neoliberal rag called The S*n), started off terribly with universal condemnation from the panel for Philip Schofield of all people. He was criticised by all for daring to ask the Prime Minister the question that was on the nation's lips: "what are you going to do about the paedophilia scandal Dave?"

The next segment was even worse and the focus of this article. It occurred after a question about Quantitative Easing in which none of the panel pointed out that the Bank of England's own research demonstrates that QE and low interest rates are severely impacting savers and people with pension schemes in order to enrich the wealthy minority (a full analysis of that shocking story can be found here).

The economist David Blanchflower sung the praises of Quantitative Easing (hardly surprising since he sat on the Bank of England monetary policy committee that introduced the policy in the first place). Then followed up with a major criticism of Tory debt fearmongering (saying that fearmongering destroys the "animal spirits"/confidence of the market) and a massively understated criticism of George Osborne's utterly catastrophic fiscal austerity policies with an observation that the UK economy has actually shrunk over the course of the last year.

The Tory Damian Green reacted in an incredible way, he openly accused Blanchflower of being wrong and told the obvious lie that:

"Over the last year the economy has been growing"Blanchflower's incredulous response to this accusation that he was wrong (or downright lying) about the economic evidence, was this:

"Just add the quarters together, it's minus 0.1"Anyone with basic maths skills could tell you what was the absolutely astonishing thing about this response: It is an example of basic mathematical illiteracy from a guy that sat in one of the most powerful positions in the UK economy (member of the Bank of England Monetary Policy Committee). The glaring error is that you never add percentage changes together, you multiply them.

Here's a simple example +20%, -20%, +20%, -20%. You might instinctively believe that the answer is what you started with (100%) but you'd be wrong. You don't add and subtract, you multiply.

Quite a difference eh? Obviously when the changes are smaller the effect is smaller too, but it is still a recognisable deviation from the number achieved through addition and subtraction. Here's how the UK growth figures measure up between Q4 2011 and Q3 2012.100% +20% = 100 x 1.2 = 120%

120% -20% = 120 x 0.8 = 96%

96% +20% = 96 x 1.2 = 115.2%

115.2% -20% = 115.2 x 0.8 = 92.16%

So Blanchflower was right about the UK economy shrinking but he had actually slightly underestimated the rate of shrinkage (which was actually minus 0.107) due to his basic mathematical illiteracy!2011 Q4 - 100% - 0.4% = 100 x 0.996 = 99.6%

2012 Q1 - 99.6% - 0.3% = 99.6 x 0.997 = 99.3%

2012 Q2 - 99.3% - 0.4% = 99.3 x 0.996 = 98.9%

2012 Q3 - 98.9% + 1.0% = 98.9 x 1.01 = 99.893%

Damian Green's response to this counter-statistic was even more incredible, he said that "it's just not true". Not only was Green lying, he actually accused the guy that was (almost) correct of being the one that was lying.

Green's second lie was even more egregious, he claimed that when the Tories came to power, the UK had the largest debt of all the major developed economies. Here's his outright lie, word for word:

Green's second lie was even more egregious, he claimed that when the Tories came to power, the UK had the largest debt of all the major developed economies. Here's his outright lie, word for word:"The reason that the 'animal spirit' of the economy was destroyed was that we had the worst debt of any G20 country, because the previous government spent money like water and left us bankrupt"

Anyone that knows anything about the history of Quantitative Easing (the subject of the question) or the economy of Japan would have recognised this as the obvious fearmongering lie that it was. After all the UK public debt is still significantly less than half of Japan's is, even now. In fact, checking the 2009 figures reveals that five of the G20 nations had significantly higher debts that the UK as a proportion of GDP (see graph) In real terms, the UK national debt ($2.183 trillion) was also significantly smaller than the United States ($14.256 trillion), Japan ($5.068 trillion), China (4.909 trillion), Germany (3.352 trillion) and France (2.675 trillion).

Whichever way you look at it, Green's assertion was an outright lie. What is more, an outright lie that gives a lot of credence to Blanchflower's point about 'animal spirits' being too low. Of course market confidence has been lower than it should be, if government ministers regularly engage in spectacularly misleading debt fearmongering such as describing the UK economy as "bankrupt" in front of a live audience and a TV audience of millions.

I don't want to dwell too much on the tribalistic dig at Labour for "spending money like water", other than to say that that also is a pretty spectacular misrepresentation. Until the global economic crisis hit, the national debt under Labour had never exceeded the 41.9% GDP debt they inherited from their Tory predecessors. Even after the spectacular financial sector meltdown in 2007-08, the debt under Labour rose to 52.1% which is significantly lower than the average debt in either the 19th or the 20th Centuries (the average debt throughout the 20th Century was 89.5% of GDP).

This kind of lying and misleading can be seen as a classic example of Tory propaganda. Outrageous lies that become universally accepted through nothing more than constant repetition. This debt fearmongering strategy is part of the tactic I defined as the Great Neoliberal Lie.

After two egregious lies in the space of a minute Green then went on to draw a stunningly one sided picture of a flourishing UK economy with a ridiculous display of cherry-picked evidence. Here's what he said.

"The two big economic measures by which governments are judged are inflation and unemployment. Inflation is half the level it was a year ago and unemployment has been falling... So actually, on the big economic measures things are getting better."There are so many problems with this statement it is difficult to know where to start. Firstly I'll question the assumption that the two most important measures of government success are inflation and unemployment. Up until the 1970s the size of the trade deficit/surplus was considered the best indicator of economic health, but ever since the British industrial sector decline began under the Thatcher administration, the Trade deficit has fallen out of fashion, simply because the figures have been so unrelentingly awful for the last three decades. In June 2012 the UK trade deficit reached an all time high of £4.4 billion and in August 2012 the second highest ever trade deficit of £4.2 billion was recorded, with a £9.8 billion deficit if only imports and exports of physical goods are included. These appalling trade figures show exactly what a desperate state the UK economy is actually in, as compared to other G20 nations such as the United States, China, Japan and Germany. These woeful figures demonstrate that the UK export market is struggling badly, leaving the economy more reliant upon imports than ever before. Other key economic indicators that Green conveniently discards as trivial include GDP growth (which has been negative for a whole year) and deficit spending (which has been intensified by the stagnant economic conditions caused by austerity).

We only have Green's assertion that we should only be judging the economy by the two measures he gives us, the ones that conveniently show the economy in a flattering light. But then, if we consider the indicators he cherry-picked in more detail we find that these are heavily distorted ways of presenting the data. I'll deal with these one at a time:

Firstly, Inflation. Green is correct that inflation has fallen from the absurd peaks of 2011, but inflation rates considered in isolation are pretty much meaningless. The best way to consider the effects of inflation is to compare the figures with other economic factors such as interest rates or wage rises. If the rates of inflation are compared with the Bank of England base rate we find that inflation has been massively outstripping interest rates. In 2011 inflation/interest ratio peaked above 1,000% on both inflationary measures (see graph).

What this means is that inflation is massively outstripping the interest earned on savings and pension schemes. Even though the headline inflation rate is much lower than the extremely high interest rates of the Thatcher years, the economic impact is much, much worse, because interest rates are not keeping pace with inflation.

Inflation peaked twice under the Thatcher administration, in May 1980 RPI inflation reached 21.9%, but the BoE base rate was 17% making a inflation/interest ratio of 128% and in October 1990 RPI inflation peaked at 10.9%, but the BoE base rate was even higher at 13.875% making an inflation/interest ratio of 79%, both significantly higher than the average throughout the Labour administration, but tiny in comparison to the incredible October 2011 inflation/ RPI interest peak of 1,080%.

Sources:

RPI & CPI inflation data

Bank of England base rates, historical data

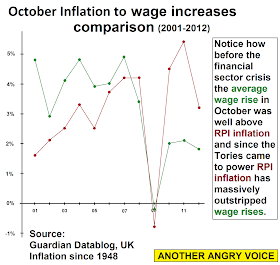

Another way in which it can be seen that inflation is actually very high is the fact that inflation has been consistently higher than wage inflation ever since the Tories came to power. Average weekly pay rises in October (change in weekly pay over 12 months) account for only 56% of the value of RPI inflation and 67% of CPI inflation, meaning that wages are shrinking in real terms. When the purchasing power of wages declines in real terms, this creates a fall in aggregate demand. If people find that their wages are not stretching as far as they were last year, they have two choices, they can either cut back spending (reducing economic demand) or borrow more money to maintain their standard of living (not good in economic terms, and not easy given the difficulty of obtaining credit these days).

Even if we ignore comparative assessment of the headline inflation figure and work with the basic numbers there are more problems. Both measures of inflation are conservative, especially the CPI (which excludes housing costs, council tax, transport costs and fuel) but the RPI is also heavily distorted by the fact that it excludes millions of low income pensioners from the calculations and the ONS are even bidding to change the way that RPI is calculated to artificially bring the rate of inflation down.

Just think about inflation it in real terms. How much has your supermarket shopping bill been rising, even though you may have been making cutbacks? How much are the costs of public transport rising? How much has the cost of petrol/diesel gone up this year? How much have your electricity and gas bills risen by? How about your water rates? Green's misleading assertions about the government's low-inflation achievements fly in the face of the everyday experience of millions of people.

Secondly, I'll deal with Green's upbeat assessment of the unemployment situation: The headline unemployment figure may have been falling for several months, but the lack of economic growth leaves us with a paradox. How can employment be rising, yet economic activity be shrinking? You have to be careful with this (perfectly reasonable) question, the Tory employment minister Iain Duncan Smith accused the BBC economics correspondent Stephanie Flanders of "pissing all over British industry" for asking exactly that question and working through some potential answers.

Here are some potential answers:

- Unemployment is falling but the proportion of workers in part-time work is near an all time high (8.1 million), with over one in four workers doing part time hours. Hence there is less money in the economy due to falling take-home salaries.

- Lots of reasonably well paid jobs (civil service, manufacturing, construction) have been lost, whilst a high proportion of new jobs are low-paid and minimum wage work, meaning that even though more people may be in work, a significantly greater proportion are earning poverty wages.

- Many millions of workers have been on pay freezes for years, which has driven down their spending power.

- Another potential answer is that the calculation methods have been rigged for political reasons on so many occasions that the headline figure of 7.8% is virtually meaningless, given that the real level of general unemployment is closer to 20%.

- Another indicator of unemployment is the number of people claiming unemployment benefits, which rose by 10,100. Quite a remarkable rise, given the increased difficulty of making benefits claims under the the coalition government.

- Yet another indicator that the unemployment situation isn't as fabulously rosy as Green would have us believe is the fact that long-term unemployment is also on the rise, with the number of people out of work for over a year rising by 12,000 to 894,000.

Even though Green cherry-picked the two economic indicators that he could actually work with to weave an absurdly misleading narrative about how everything is getting better, closer examination reveals that both inflation and unemployment are significantly worse than the impression created if the headline figures are considered in isolation. General unemployment is closer to 20% than 7.8% and inflation, when considered in relation to interest rates or wages is far higher than anything experienced during the previous Labour administration, and in fact far worse even than the inflationary spikes during the Thatcher years.

If we consider other key economic indicators, the picture is just as bad: Economic growth (minus 0.113% over the course of an entire year), deficit spending (debt increases as a percentage of GDP comparable to the scale of borrowing needed to fund the Great War and the World War), the trade deficit (2 all time highs in recent months), trade deficit in goods (£9.8billion in August), Exports (minus 1.2% in August) manufacturing output (minus 1.1% in August), construction (shockingly bad figures with an 11% overall decline between Q3 2011 and Q3 2012), Consumer Confidence (an October decline in consumer confidence, a continuation of the appallingly bad long-term low confidence trend under the Tory led government). Wherever you look there is plentiful evidence that the UK is in chaos, with just a tiny pocket of extremely wealthy people insulated from the devastating effects of Tory economic mismanagement and the Bank of England's stagflationary monetary policies.

Conclusion

I realise that this is a bloody long article to make the point that a particular politician is a liar and a manipulator. I mean the growing levels of cynicism about British politics mean that the majority of people seem to accept the idiom that the best way to tell if a politician is lying is by looking to see if his lips are moving. Damian Green however, is a particularly loathsome and transparent liar, even by modern political standards.When he got caught in his first lie, he simply accused his opponent of lying about the facts. He used his second lie to counter accusations that Tory economic fearmongering had damaged market confidence, a lie that was a particularly egregious display of completely inaccurate Tory debt fearmongering, which completely reinforced the point that his opponent had made about market confidence being damaged by fearmongering. Chuck in a bit of inaccurate tribalistic political point scoring and he managed three stunningly obvious lies in the space of a minute.

He then followed up this blunderbuss of lies with an audaciously rosy assessment of the state of the UK economy, which relied upon cherry picked statistics and lame anecdotes. Anyone with half a brain in the audience could tell that things are not nearly as great as Green would have us believe.

The fact is, that this man feels completely at ease telling obvious lies to huge audiences, and that barely a word that comes out of his mouth is not some kind of lie or distortion. As long as flagrant liars like Damian Green are given the oxygen of publicity, public trust in the political classes will never come close to recovery.

In a government of liars and manipulators, Damian Green is such a bold and bad liar he stands out as particularly dishonest. I have attempted to show (using evidence and analysis) exactly how much of a transparent liar the man is. Hopefully, next time you see the man speak, you'll take whatever he says with a wheelbarrow full of salt.

See also

An entirely avoidable "Osbornomic" recession

How Quantitative Easing is bad for the economy

What is... Quantitative Easing?

What is... A Justification Narrative?

An entirely avoidable "Osbornomic" recession

How Quantitative Easing is bad for the economy

What is... Quantitative Easing?

What is... A Justification Narrative?

Nice one Thomas. I love it when the Tories get a verbal kicking!

ReplyDelete